Faced with huge losses of revenue, Michigan cities and villages cut their collective payrolls by $1.2 billion — from $3.6 billion a year in 2002 to $2.4 billion a year in 2012 — a one-third reduction, according to the Southeast Michigan Council of Governments (SEMCOG).

Writing on the SEMCOG blog, Bill Anderson, the council’s government finance and operations specialist, noted that new U.S. Census data released earlier this week that cities faced with dramatic budget cuts went far beyond holding salaries to the rate of inflation.

“Of all of the numbers that I looked at, the fact that Michigan’s cities had to reduce their payrolls by a third from 2002 to 2012 is the most concerning,” Anderson said. “In many cases staffing levels were reduced or hours of operations cut back, which significantly impaired the ability of many cities to deliver services to their residents. Of even greater concern is that under Michigan’s local government financing structure it is unlikely that service levels will ever be restored.”

Layoffs, wage concessions and reduced working hours all play a part in the numbers. At the same time, cities have been hit hard by big cuts in state revenue sharing that were imposed by the Legislature, and by precipitous losses in property tax revenues that were caused by unprecedented declines in home values.

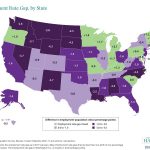

Anderson also pointed out that salary growth for Michigan’s local government employees has been at half of the rate for all local government employees nationally, even after taking into account changes in the state’s population. Overall, Michigan’s local governments – cities, villages, townships, counties and schools — saw their collective payrolls increase by just 0.3 percent over 10 years, while nationally local government payrolls increased by 33.8 percent.

Anderson offered this caution:

The concern of Michigan’s local governments is that the state’s financing mechanisms (established by Proposal A of 1994) for their operations do not allow a “recovery” from the impact of the recession. The strict limitations on property-tax growth will likely mean that local governments will continue to grow at a much slower pace than similar governments in other states from a now-diminished base. The ability to provide basic services, particularly in areas that are funded by local property tax revenues, are likely to continue on a path of decline compared to the rest of the nation.