For the fourth consecutive year, Michigan ranks near the top of the nonpartisan Tax Foundation’s State Business Tax Climate Index, which measures the degree to which a state’s tax system is friendly to employers.

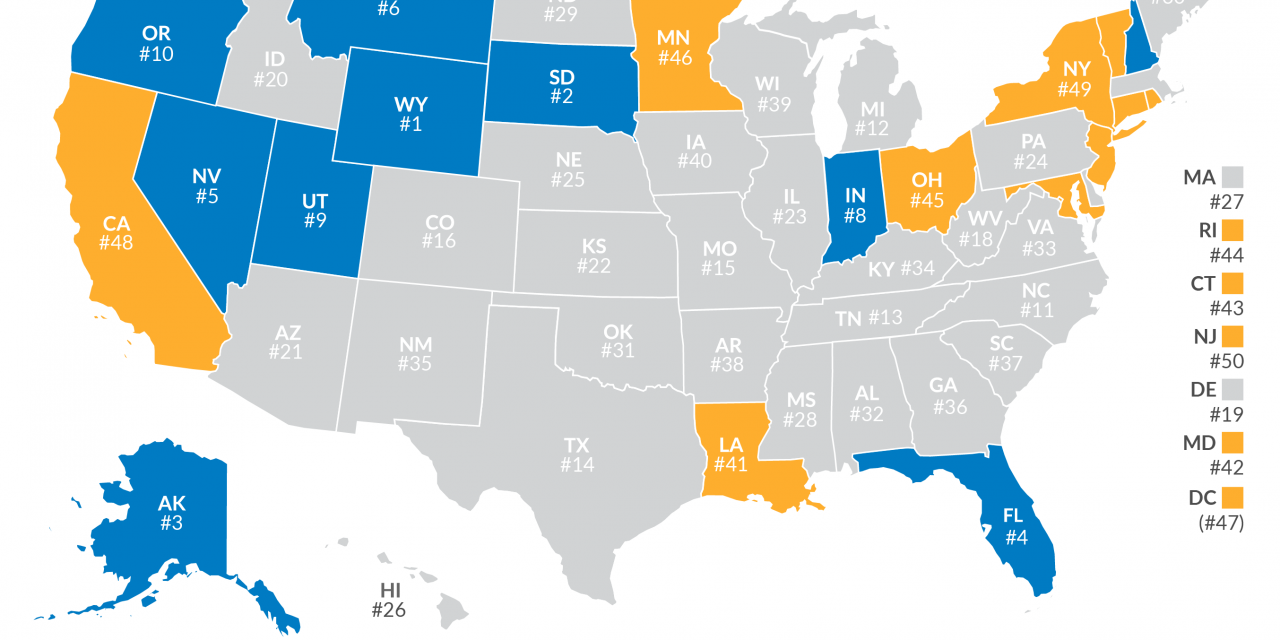

Michigan ranked 12th among the 50 states for 2017 — meaning current tax rates that will apply on next year’s tax returns. That’s the same ranking the Great Lakes State enjoyed in 2016 and 2015. In 2014, Michigan was 11th.

The Tax Foundation’s newest analysis found that Michigan is rated 8th-best in corporate taxes, 14th in individual income taxes, 9th in sales taxes, and right in the middle of the pack for property taxes, at 25. The state’s biggest weakness is an unemployment tax that is ranked near the bottom at 47.

No doubt the $1.8 bill business tax cut proposed by Gov. Rick Snyder and adopted by the Legislature in 2011 provided a big boost in terms of the corporate perception of Michigan, though the economic results are scanty.

The Business Tax Climate Index goes beyond tax rates and revenues to judge how well state’s structure their tax systems, keeping levies low, simple and broadly based.

The 10 best states in this year’s Index are:

- Wyoming

- South Dakota

- Alaska

- Florida

- Nevada

- Montana

- New Hampshire

- Indiana

- Utah

- Oregon

It should be noted that four of these states – Wyoming, South Dakota, Alaska and Montana – probably do not present much competition for Michigan based on a Quality Of Life/Things To Do scale.

In addition, the Tax Foundation reports that most of the Top 10 states do not levy certain basic taxes at all. Substantial revenues from oil and gas, or tourism, all provide for a leaner tax structure. For example, Alaska has no individual income or state-level sales tax. Florida has no individual income tax.

Other examples are Wyoming, Nevada, and South Dakota, which have no corporate or individual income tax (though Nevada imposes a gross receipts taxes). New Hampshire, Montana, and Oregon have no sales tax.

Among the worst states, they are plagued by relatively high rates and convoluted layers of taxation. Case in point: New Jersey, the 50th ranked state, is one of just two states that levy both an inheritance tax and an estate tax.

However, it should be noted that some states that rate poorly in terms of business-friendly taxation still have strong economies.

The 10 lowest-ranked states in the Index are:

- Louisiana

- Maryland

- Connecticut

- Rhode Island

- Ohio

- Minnesota

- Vermont

- California

- New York

- New Jersey