Over the past decade or so, Michigan’s national ranking compared to other states has shrunk precipitously in median income, poverty rates, college-degree attainment and wage growth – along with several other categories.

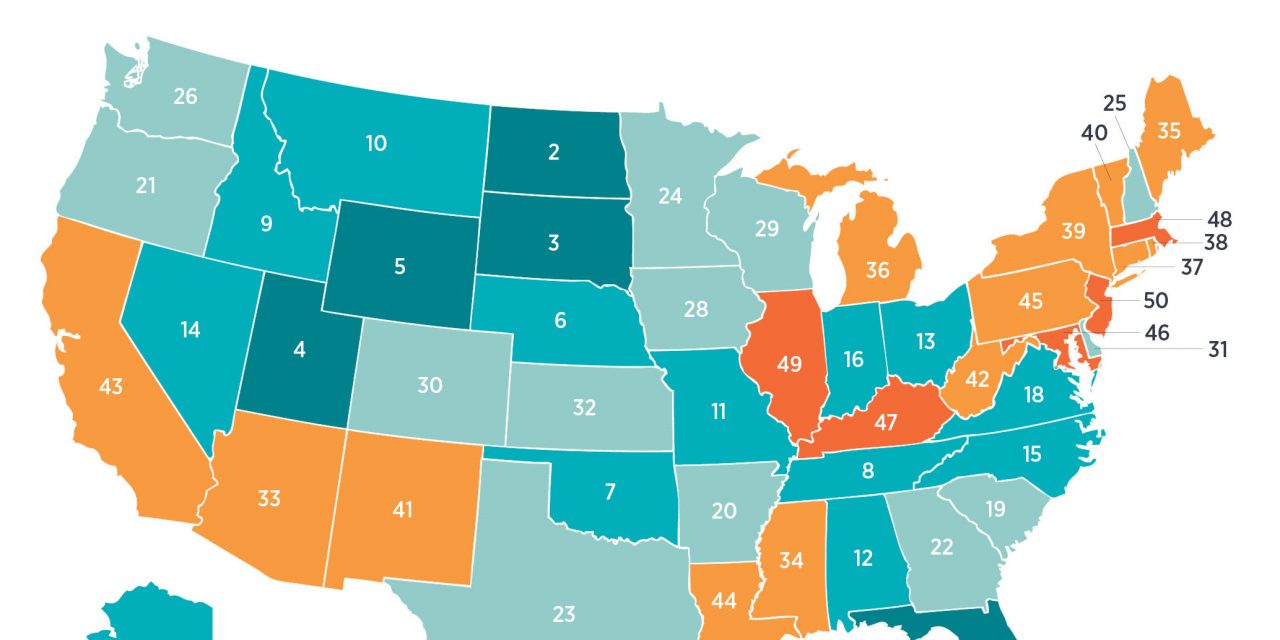

Now comes a new study that puts Michigan at 36th among the 50 states in the financial stability of our state government.

The conservative Mercatus Center at George Mason University in suburban Washington finds that we lag behind most of the country in a broad measurement of factors that could be best summarized as state budget health – short term and long term.

The study ranks each state based on current budget trends plus debts and other key fiscal obligations, such as unfunded pensions and healthcare benefits for state retirees.

At the same time, Michigan under Gov. Snyder has successfully avoided the immediate budget shortfalls projected among many states for the 2017 or 2018 fiscal years.

Still, Michigan ranks well into the bottom tier of states in the Mercatus study based on cash solvency, budget conditions, and future liabilities. The state’s $36 billion gap in public sector pension obligations ranks the ninth-worst in the U.S. when compared to the personal income of Michigan residents.

Another Mercatus measure that compares financial red ink to average state taxpayers’ ability to afford expensive fixes ranks Michigan as fifth-worst in terms of funding promised retiree health care benefits for former state employees.

Overall, Florida ranks first as the most fiscally healthy state, while New Jersey ranks the lowest.

Sparsely populated rural states – in order, North Dakota, South Dakota, Utah and Wyoming – follow Florida as the most financially stable states.

The worst of the worst presents a mish-mash of the American landscape. Ranking behind New Jersey as the most fiscally unhealthy states are Maryland, Kentucky, Massachusetts and Illinois.

In numerous states, policy debates consist of a basic conundrum: Offer business tax breaks to lure new employers, which could generate new tax revenues, or focus on austerity budgets that keep finances in line.

In Michigan, the Snyder administration has previously warned that the state faces long-term budget pressures, including $2.1 billion in previously approved tax and fee cuts for businesses dating back to the Granholm administration that will drain state coffers over the next three years.

Yet, in recent weeks the Republican governor has pushed hard for new tax incentives that critics call “corporate welfare.” The competition between states, based on who can offer the most lucrative tax cuts for a potential employer, has continued unabated for the past three decades.

Earlier today, the state House approved a $200 million business tax windfall designed by Snyder to lure a Taiwan-based electronics manufacturing giant to Michigan.

With the full House convening in Lansing for its only scheduled work-day in July, the so-called “good jobs” package received approval in a series of 71-35 bipartisan votes, with the GOP prevailing. The bill now goes back to the Senate, which is expected to sign off on House changes and send the legislation to Snyder’s desk.

The Detroit News characterized today’s action in the state Capitol this way:

Final approval will be a significant legislative victory for Snyder, who warned Tuesday that various job-creation opportunities “would likely disappear” if the House did not pass the incentive plan on its only scheduled session day of July.

Michigan is among a small group of states competing for thousands of potential jobs at manufacturing facilities that Foxconn, a Taiwanese company that assembles the Apple iPhone in China, intends to open in the United States.