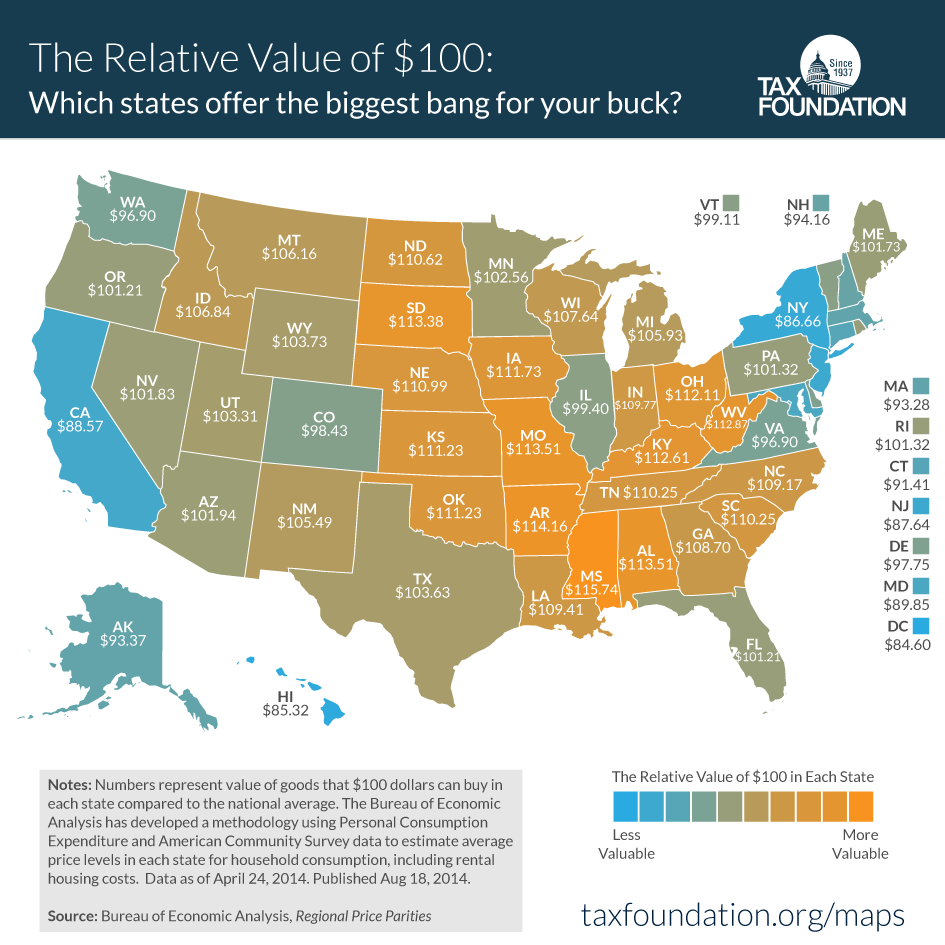

The Tax Foundation has compiled an interesting map that should

have implications for tax rates and social welfare programs in each state.

have implications for tax rates and social welfare programs in each state.

The foundation researchers took a look at federal data and came up

with the true value of $100, based on the cost of living, in all 50 states.

Michigan is on the plus side, at about $105, but the valuations vary

dramatically across the nation.

with the true value of $100, based on the cost of living, in all 50 states.

Michigan is on the plus side, at about $105, but the valuations vary

dramatically across the nation.

The states/territories where $100 is worth the least are the

District of Columbia ($84.60), Hawaii ($85.32), New York ($86.66), New Jersey

($87.64), and California ($88.57). That same money goes the furthest in

Mississippi ($115.74), Arkansas ($114.16), Missouri ($113.51), Alabama

(113.51), and South Dakota ($113.38).

District of Columbia ($84.60), Hawaii ($85.32), New York ($86.66), New Jersey

($87.64), and California ($88.57). That same money goes the furthest in

Mississippi ($115.74), Arkansas ($114.16), Missouri ($113.51), Alabama

(113.51), and South Dakota ($113.38).

The implications for political decisions and public policy could

be enormous. Here’s how the Tax Foundation describes the current situation:

be enormous. Here’s how the Tax Foundation describes the current situation:

“Furthermore, this (divide in cost of living) affects means-tested

federal welfare programs. A poor person in a high-cost area – like Brooklyn or

Queens – may be artificially boosted out of the range of income where they are

eligible for welfare programs, despite still being very poor. At the same time,

many people in low-price states may be eligible for welfare programs despite

actually being much richer than they appear. If the same dollar value program

is offered in New York City and rural South Dakota, it may be too small to help

anyone in New York City, and yet so big it discourages work in South Dakota.”

federal welfare programs. A poor person in a high-cost area – like Brooklyn or

Queens – may be artificially boosted out of the range of income where they are

eligible for welfare programs, despite still being very poor. At the same time,

many people in low-price states may be eligible for welfare programs despite

actually being much richer than they appear. If the same dollar value program

is offered in New York City and rural South Dakota, it may be too small to help

anyone in New York City, and yet so big it discourages work in South Dakota.”