It’s Tax Day in the U.S., that annual ritual when average workers are anxious and angry as they try to meet the IRS filing deadline while partisans in Washington desperately try to score political points by promoting their tangential views of the federal tax system.

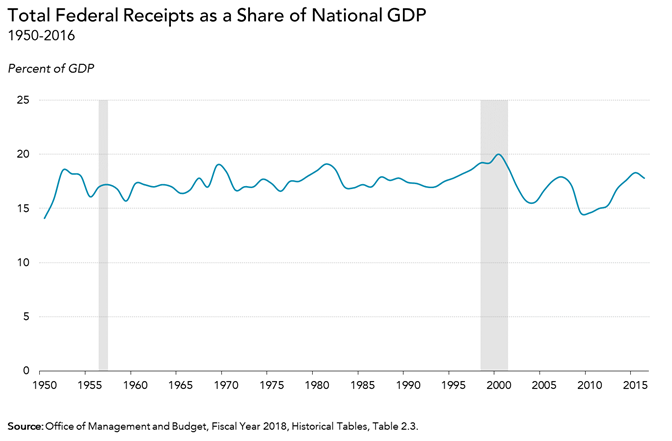

The fact is that federal income tax revenues, as a percentage of the U.S. economy, the GDP, have remained within a narrow window of 15 to 20 percent going all the way back to 1950, when Harry Truman was president.

Another fact is that most middle class Americans pay a federal income tax — the “effective” rate — of less than 10 percent, once they claim all their IRS deductions and credits.

Yet another fact is that tax cuts as a policy produce a minimal effect on economic growth, as numerous studies have shown that the trickle-down approach has registered minimal impact on jobs and business success.

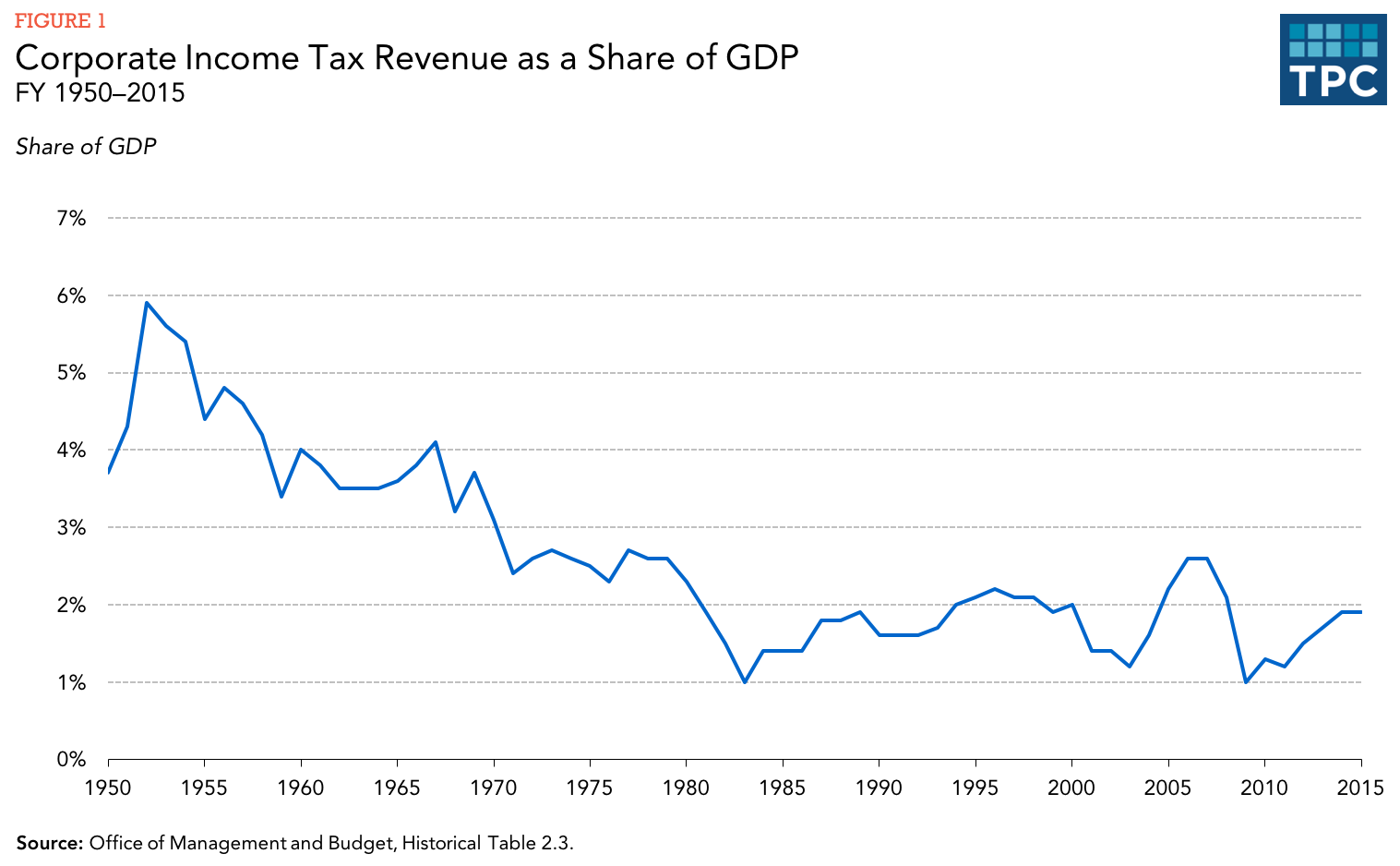

Tax Day this year marks a different political metric as it comes on the heels of a massive tax bill adopted by the Republican Congress that lowered individual income tax rates – mostly tilted in favor of upper income families — while dramatically reducing the U.S. corporate tax rate by 67 percent, from a maximum level of 35 percent down to 21 percent.

The gray areas of this graph indicate times when the federal budget was balanced.

In recent months, we have seen major corporations offering their workers one-time bonuses or even permanent wage increases as a means of sharing their tax windfall with their workforce. Yet, the impact has been far less widespread than GOP tax-cutters had hoped. Many companies are engaging in good ol’ boys stock buyouts instead.

A new NBC News/Wall Street Journal poll found that only around a quarter of Americans believe the tax cut was a good idea. Of course, Democrats are substantially in opposition but only 56 percent of Republicans thought the new tax law was a good idea.

Some workers, not a lot, have benefited from bonus checks – it all depends who you work for. The Michigan GOP put out a Tax Day tweet that said over 500 companies have awarded tax-based bonuses to 4 million Americans. Sounds impressive. Until you consider that more than 5 million companies benefited from the corporate tax cut.

While outgoing House Speaker Paul Ryan wears the tax overhaul as a GOP badge of honor, at a largely overlooked President Trump event in West Virginia earlier this month Trump gave short-shrift to the tax legislation that serves as the overwhelmingly biggest accomplishment of this GOP Congress.

Shortly after beginning his remarks, Trump tossed the White House’s prepared script on tax cuts into the air, dismissed the text as “boring,” and detoured into a diatribe about an annual ritual of Central Americans marching through Mexico. It was a perceived Hispanic invasion of the U.S. border that never happened.

Beyond that distraction, taxpayers need to realize that partisan tax-policy politics have been used incessantly to sway their views at election time. In this case, at the upcoming mid-term elections for Congress in November.

Ask yourself this: If the latest version of trickle-down economics is so obviously beneficial to average Americans, why have ultraconservative political groups spent $7 million on advertising the tax cuts since the start of the year and on Monday announced another $1 million round of national television and digital ads?

Liberal Democratic groups are trying to fight back within the realm of political sales pitches, though a favorite GOP target, House Minority Leader Nancy Pelosi, gave the Republicans an opening when she said foolishly said that non-wealthy Americans will get “crumbs” from the tax cuts.

At the same time, the president latched onto the election-year GOP talking points when he claimed that average families would enjoy a “$4,000 raise” from the tax plan in the form of bonuses, wage hikes and benefits from an improved economy. Even for a huckster like Trump, that was quite a stretch that could hurt the GOP in November congressional elections.

Most significantly, the new tax bill defies conventional economic thinking by providing a big stimulus at a time when the U.S. economy is essentially at full employment. Early indications are that the most unsustainable impact may be a big assist in creating unprecedented federal budget deficits over the next decade.

If this keeps up, many Americans of all political persuasions may finally realize that taxes have little sway over their paycheck, but they do have a long-term bearing on their daily lives.