The idea that Michigan’s economy could be doing better, if not for high taxes on business, took another hit recently as the nonprofit Tax Foundation announced that the state still ranks near the bottom in corporate income tax burdens.

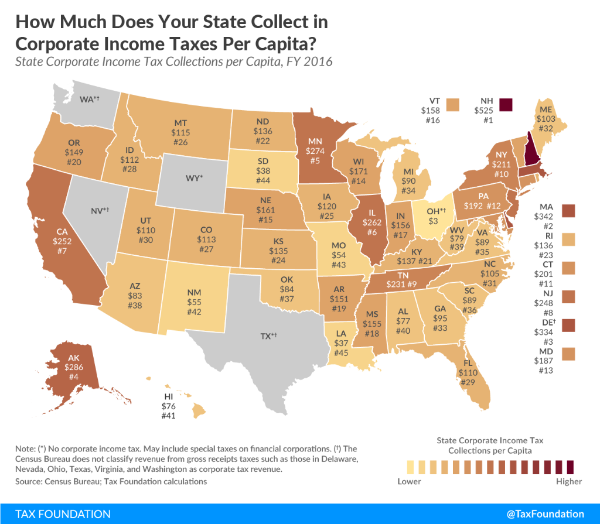

The center-right Tax Foundation has revealed its newest state-by-state 2018 rankings based on corporate taxes and Michigan came up at No. 34, with a business tax weight that equates to just $90 per person, per year.

By way of textbook economics, the huge $1.8 billion corporate tax reduction successfully pushed by Gov. Rick Snyder in 2011 should have resulted in substantial economic growth. But evidence that the tax cuts have made Michigan a prime destination for corporate America is pretty thin. Michigan previously ranked 33rd among all states in 2017, with a corporate tax that had amounted to $119 annually on a per-capita basis.

As for the nationwide 2018 ratings, Michigan receives a better grade than numerous conservative Red States, including Mississippi, Arkansas, Nebraska and Utah.

The Tax Foundation reports that corporate tax collections are highest in New Hampshire and Massachusetts, at $525 per-capita and $342-per capita, respectively. Some of the high-tax states, including Delaware, face harsh criticism from the business community for levying a gross receipts tax, based on a company’s annual revenues, as did Michigan in the past.

Six states do not levy a corporate income tax (Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming), but four of the six (Nevada, Ohio, Texas, and Washington) levy a gross receipts tax.

Katherine Loughead of the Tax Foundation reports that low corporate taxes at the state level have become common as “many businesses have shifted away from the traditional C corporation (tax) structure and are instead structured as ‘pass-throughs,’ which pay income taxes using the individual income tax system.”

In addition, state lawmakers and governors realize that, without pass-through payments by corporate executives, business income tax revenue can vary dramatically from year to year.

What’s more, the prevailing view is that corporate income taxes are more detrimental to economic growth for states than personal income taxes, sales taxes, and property taxes.

To get a detailed look at how Michigan corporate taxes compare to other states, click here.

I think that there has been a shift of the costs of government services from businesses onto individual citizens. In addition to the benefits that businesses received from the shift from the Michigan SBT to income tax, Lansing eliminated most of the personal property taxes on businesses. If that wasn’t enough, hardly a manufacturing facility (or one of Amazon’s fulfillment centers) gets built without applying to local governments for tax abatements through Brownfield credits and the IFECs (Industrial Facilities Exemption Certificates). Beginning in 2017, the state of Michigan and other government entities were required to disclose the annual cost of those (and other) exemptions in the footnotes to their financial statements. In 2017 the State of Michigan reported over $750 million abated taxes. All that money was money that corporations kept for themselves and wasn’t used to support our schools, police and fire departments, or fix the roads.