On Mackinac Island, there’s plenty of talk about making Michigan’s economy more competitive by ending our “high-tax state” reputation.

Conservative Republicans and business titans attending the annual Mackinac Policy Conference relish the opportunity to prolong this myth.

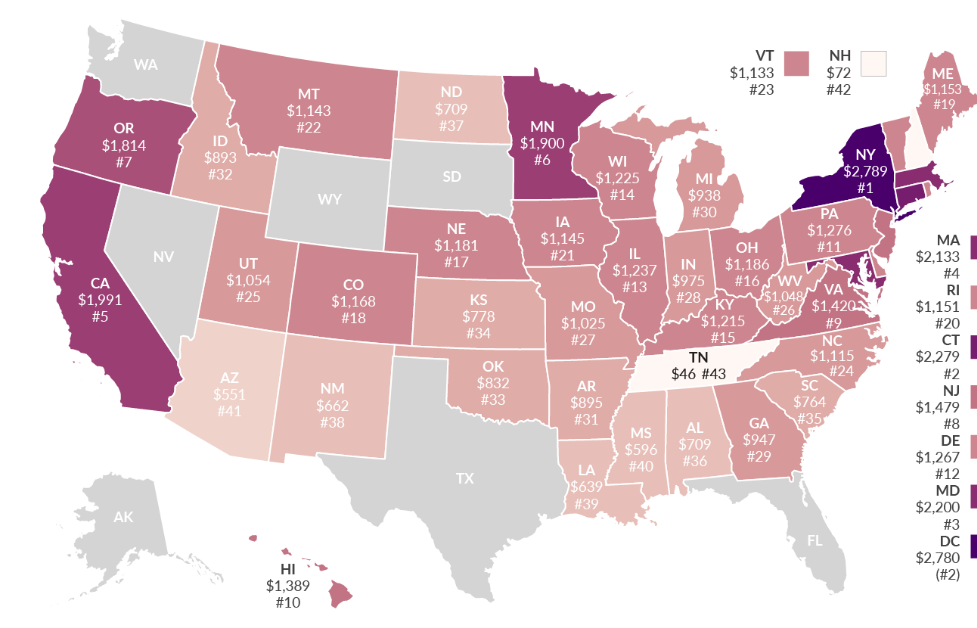

Meanwhile, the nonpartisan Tax Foundation today published its newest report on state/local income tax burdens and they found that Michigan ranks 30th, with an average per-capita tax of $938 a year. Michigan’s tax burden rates lower than several conservative Red States such as Kentucky, Arkansas, Montana, Utah, West Virginia, Georgia and North Carolina.

Based on 2015 rates (the most current information available), three of our biggest neighboring states — Wisconsin (14), Illinois (13) and Ohio (16) — rank much higher than Michigan.

Overall, state and local governments collect an average of $1,144 per person in individual income taxes, but collections varied widely from state to state. Seven states levy no income taxes and two others only collect taxes on income from investments and savings.

In Michigan, it should also be noted that the Tax Foundation’s latest analysis of states’ business tax climates ranks our state as 12th best on the list. Of all the state services provided, and state assistance to services at the local level, the Michigan business community provides just 2.9 percent of the tax revenue that foots the bill.

Minnesota…where you pay $1,000 a year more in taxes and get $8,000 a year more in income when compared to Michigan. That’s called “a good investment,”